2014/8/25

Aerospace Industrial Development Corporation (AIDC) was officially listed on the Taiwan Stock Exchange (TWSE) on August 25th. The reviewing process of AIDC’s listing application was completed by TWSE on May 12th and the application approved on May 20th. AIDC is now one of nine companies being listed this year on the Taiwan Stock Exchange.

With capital stock in $9.08 billion NT dollars, AIDC consummated its privatization through public release of its stock by way of open bidding, public subscription, and stock subscription for employees, which inclusively constituted 53.98% of equity interest. AIDC’s initial public offering infused $9.34 billion NT dollars to the Treasury with selling price at $16.84 NT dollars per share and net asset value at $10.28 NT dollars (by 2014Q2). It’s the biggest privatization project for the government-owned companies in decade.

AIDC was previously a subsidiary founded in 1969 under the Ministry of National Defense. It became a government-owned enterprise in 1996 and transitioned from a military aviation oriented R&D base to a market-oriented commercial entity thriving in both military and civil aviation businesses.

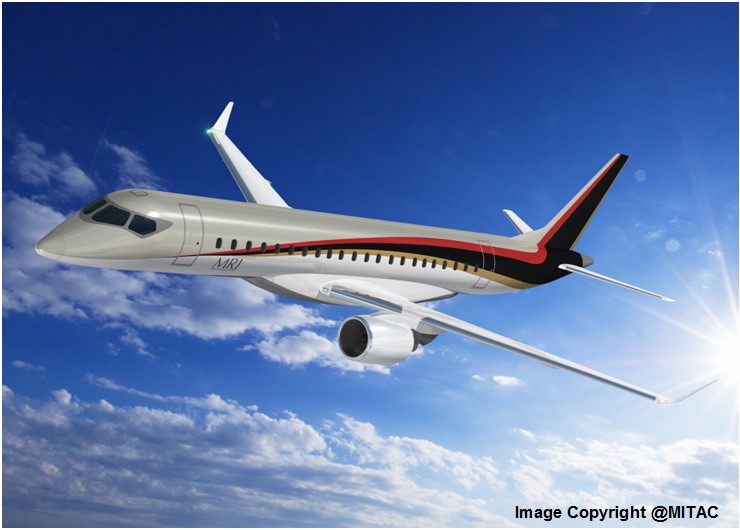

In the past 18 years as a commercial entity, AIDC invested heavily in R&D and the establishment of the Quality System for its commercial aviation projects. With joint projects undertaken with the world’s leading aviation companies, valuable experiences have been gained which well-equipped AIDC with the expertise and capability in aircraft system integration, aircraft development, parts manufacturing, composite fabrication, special process development, aircraft assembly, testing and verification. With a recent new order from Airbus for the composite belly fairing, AIDC is now among the 1st class suppliers for Airbus.

Apart from aero structures, AIDC also possesses comprehensive capabilities in the aero engine production including new parts development, concurrent engineering, casting, special processing, and well-established expertise in casing manufacturing. AIDC’s strength is well recognized by the world’s most prestigious aero engine builders and has become an important partner for the world’s top 5 engine providers. The casings delivered by AIDC are to be seen on all the popular models of aero engines currently in the market.

With recent performance, AIDC’s revenue grew from $20.1 billion NT dollars in 2011 to $23.09 billion NT dollars in 2013. The revenue of the first 2 Quarters for 2014 is $10.96 billion NT dollars. The net profit before tax grew from $1.13 billion NT dollars in 2011 to $1.39 billion NT dollars in 2013. The earning per share grew from $1.24 NT dollars in 2011 to $1.42 NT dollars in 2013. The EPS for the first 2 Quarters of 2014 was $0.92 NT dollars.

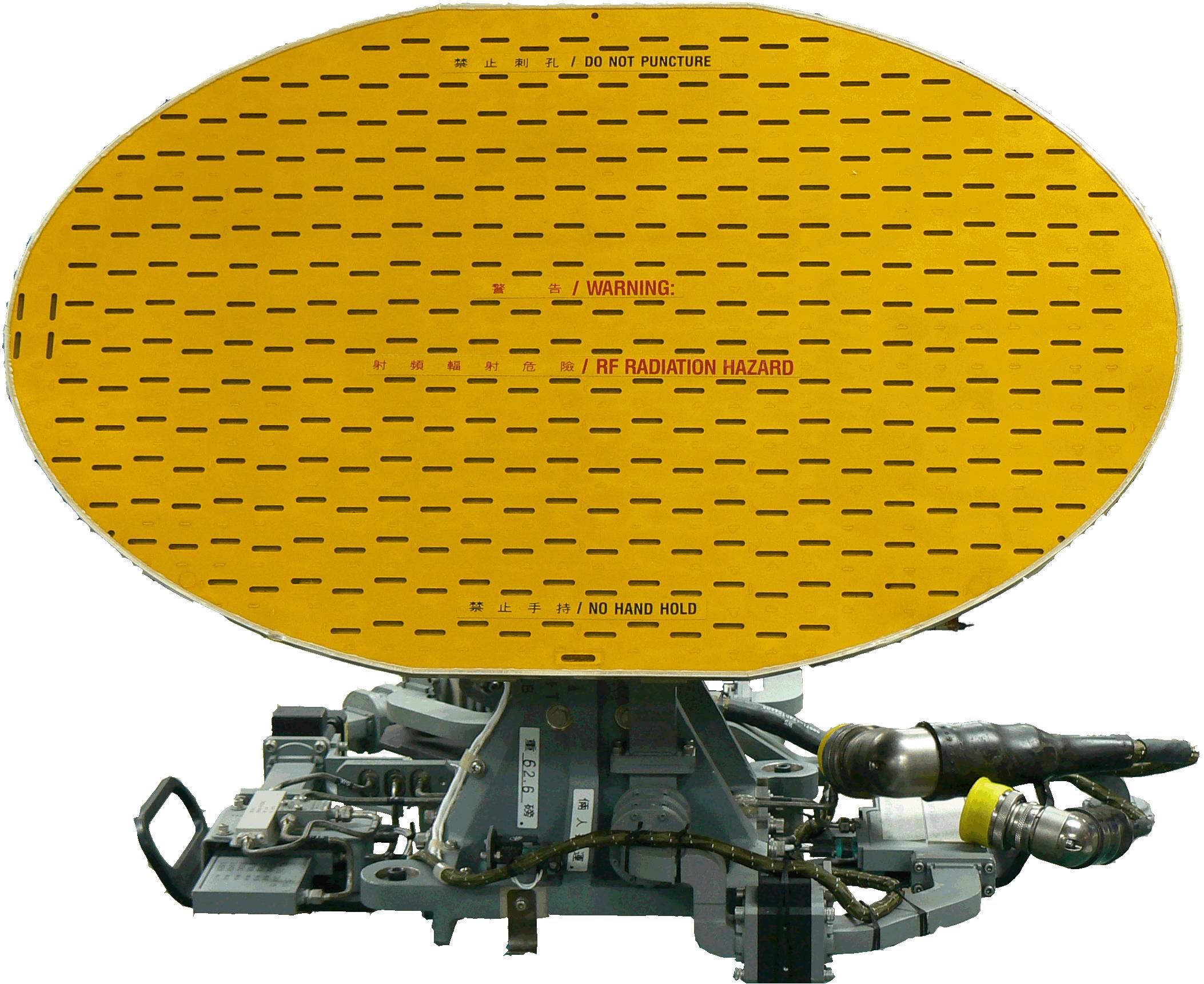

After privatization, AIDC remains committed to satisfying Taiwan's self-reliant defense goals for stronger national security, and to the development of the aerospace industry with the vision to become the first rate aerospace and technologies provider who positions itself as a high-quality supplier, a navigator of the domestic aviation industry, a high-proficiency business operator, and a practitioner of community responsibilities.

With capital stock in $9.08 billion NT dollars, AIDC consummated its privatization through public release of its stock by way of open bidding, public subscription, and stock subscription for employees, which inclusively constituted 53.98% of equity interest. AIDC’s initial public offering infused $9.34 billion NT dollars to the Treasury with selling price at $16.84 NT dollars per share and net asset value at $10.28 NT dollars (by 2014Q2). It’s the biggest privatization project for the government-owned companies in decade.

AIDC was previously a subsidiary founded in 1969 under the Ministry of National Defense. It became a government-owned enterprise in 1996 and transitioned from a military aviation oriented R&D base to a market-oriented commercial entity thriving in both military and civil aviation businesses.

In the past 18 years as a commercial entity, AIDC invested heavily in R&D and the establishment of the Quality System for its commercial aviation projects. With joint projects undertaken with the world’s leading aviation companies, valuable experiences have been gained which well-equipped AIDC with the expertise and capability in aircraft system integration, aircraft development, parts manufacturing, composite fabrication, special process development, aircraft assembly, testing and verification. With a recent new order from Airbus for the composite belly fairing, AIDC is now among the 1st class suppliers for Airbus.

Apart from aero structures, AIDC also possesses comprehensive capabilities in the aero engine production including new parts development, concurrent engineering, casting, special processing, and well-established expertise in casing manufacturing. AIDC’s strength is well recognized by the world’s most prestigious aero engine builders and has become an important partner for the world’s top 5 engine providers. The casings delivered by AIDC are to be seen on all the popular models of aero engines currently in the market.

With recent performance, AIDC’s revenue grew from $20.1 billion NT dollars in 2011 to $23.09 billion NT dollars in 2013. The revenue of the first 2 Quarters for 2014 is $10.96 billion NT dollars. The net profit before tax grew from $1.13 billion NT dollars in 2011 to $1.39 billion NT dollars in 2013. The earning per share grew from $1.24 NT dollars in 2011 to $1.42 NT dollars in 2013. The EPS for the first 2 Quarters of 2014 was $0.92 NT dollars.

After privatization, AIDC remains committed to satisfying Taiwan's self-reliant defense goals for stronger national security, and to the development of the aerospace industry with the vision to become the first rate aerospace and technologies provider who positions itself as a high-quality supplier, a navigator of the domestic aviation industry, a high-proficiency business operator, and a practitioner of community responsibilities.

.jpg)