2015/4/27

Following eight months after its privatization and listing on the Taiwan Stock Exchange, the Aerospace Industrial development Corporation (AIDC), the leading manufacturer in Taiwan’s aerospace industry, held an Investor Conference this afternoon. AIDC Chairman, Liao Jung-Hsin presided over the conference and President, Hsu, Yen-Nien presented overviews on the company’s; Marketing, Operating Performance, Financial Statement as well as AIDC’s Prospects.

AIDC’s annual revenue in 2014 was NT$24.924 billion which was 8% growth compared to CY2013;net profit NT$1.872 billion, growing 45% compared to the previous term; gross operating profit was NT$2.765 billion, which increased 23% compared to the previous term; earnings was NT$2.06 per share. Cash dividend of NT$0.92 per share (earnings distribution) was deferred for approval during the company’s annual shareholders’ meeting anticipated this coming June.

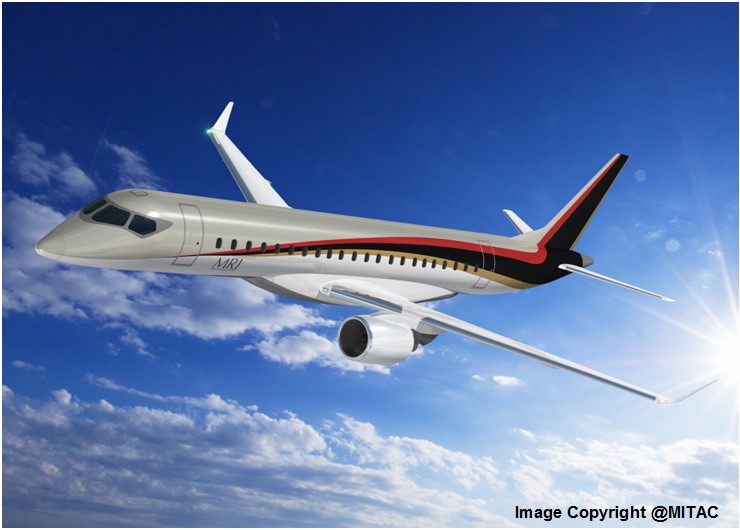

The presentations by President Hsu, Yen-Nien, indicated AIDC’s business pattern was developed both on military and commercial in recent years, not just in military aircraft. The amount of new orders in 2014 exceeded NT$40 billion which met expectations, orders in hand in the next five years are estimated to exceed more than one hundred billion. The outlook in the near future remains optimistic. To meet the future robust market demands and maintain the indigenous products service as well as the core technology capability, AIDC plans to invest approximately NT$2.4 billion on fixed assets in 2015 including; F16 A/B Upgraded Maintenance Building, Engine Case Manufacturing Center and TACC-19 (Composite Material) building. AIDC forecasts the operating performance is optimistic for this year; in addition to the commercial business will be consistent with the growth and the trend of the global aerospace industry development, the military business will also continue to grow as well. AIDC will gear up and endeavor to reach this year’s operational goals.

AIDC’s annual revenue in 2014 was NT$24.924 billion which was 8% growth compared to CY2013;net profit NT$1.872 billion, growing 45% compared to the previous term; gross operating profit was NT$2.765 billion, which increased 23% compared to the previous term; earnings was NT$2.06 per share. Cash dividend of NT$0.92 per share (earnings distribution) was deferred for approval during the company’s annual shareholders’ meeting anticipated this coming June.

The presentations by President Hsu, Yen-Nien, indicated AIDC’s business pattern was developed both on military and commercial in recent years, not just in military aircraft. The amount of new orders in 2014 exceeded NT$40 billion which met expectations, orders in hand in the next five years are estimated to exceed more than one hundred billion. The outlook in the near future remains optimistic. To meet the future robust market demands and maintain the indigenous products service as well as the core technology capability, AIDC plans to invest approximately NT$2.4 billion on fixed assets in 2015 including; F16 A/B Upgraded Maintenance Building, Engine Case Manufacturing Center and TACC-19 (Composite Material) building. AIDC forecasts the operating performance is optimistic for this year; in addition to the commercial business will be consistent with the growth and the trend of the global aerospace industry development, the military business will also continue to grow as well. AIDC will gear up and endeavor to reach this year’s operational goals.

.jpg)